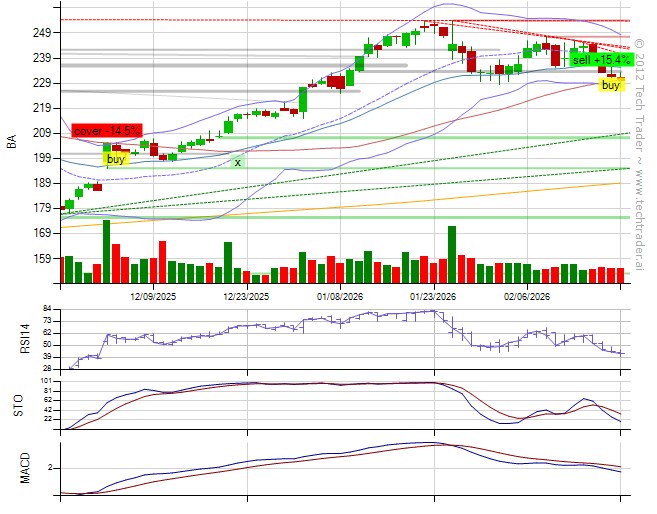

Feb 23rd, 2026 1:56:34 PM PT

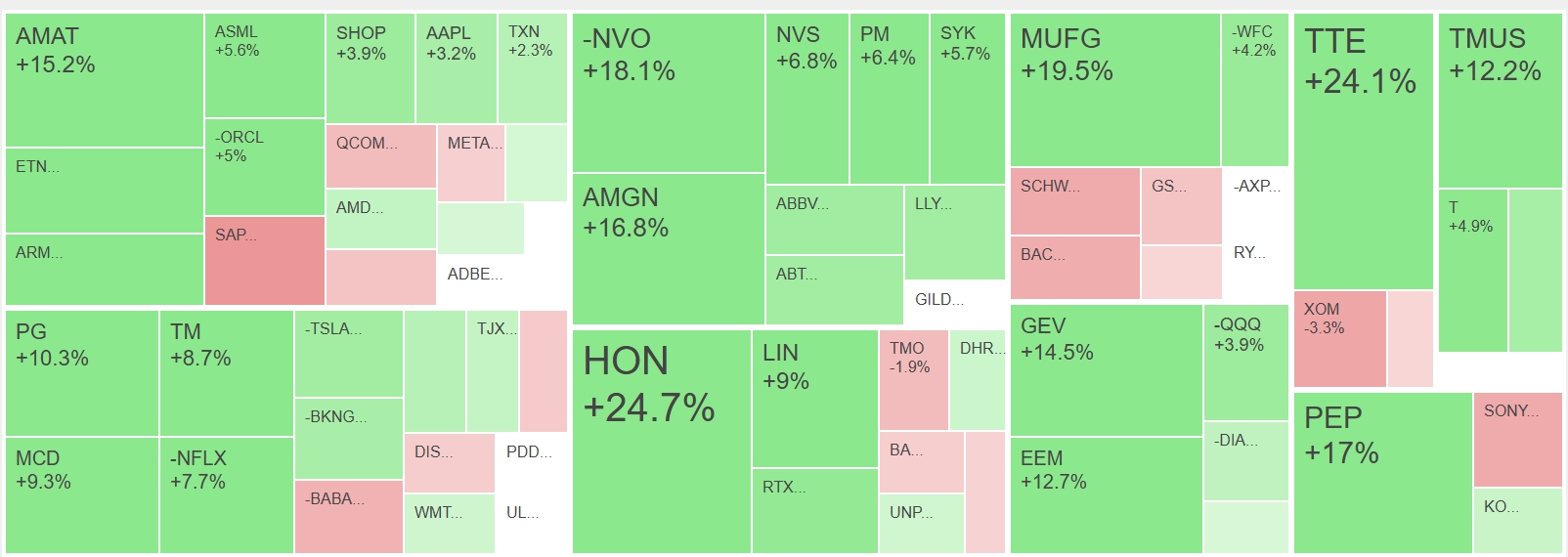

Today's portfolio summary with @Grok:

Down 0.7% with S&P500 down 1.2%.

Bought

$GILD,

$IWM,

$PDD,

$ADBE,

$UL,

$NEE,

$ANET.

Shorted

$AXP.

Sold

$SPGI,

$C,

$MS,

$BX,

$MSFT,

$ACN,

$PLTR,

$JPM,

$IBM,

$PFE,

$V,

$BLK,

$INTU,

$MA,

$ISRG,

$AMZN,

$CRM,

$PGR,

$UNH.

61% long by 9% short. 15% long Technology, 8% long Industrials, 7% long Health Care, 6% long Consumer Discretionary.

Feb 23rd, 2026 1:44:29 PM PT

Sold

$CRM at $177.38 (-4%).

From @Grok (API): "Exiting LONG to CASH as CRM breaks to new multi-year lows in persistent bearish downtrend with high-volume selling and recent layoffs signaling weakness, despite oversold indicators and upcoming Q4 earnings on Feb 25."

Read more...

Feb 23rd, 2026 1:42:27 PM PT

Sold

$AMZN at $204.9 (+3%).

From @Grok (API): "Exit long to cash as AMZN drops back to 204.88 failing to sustain rebound above 210 amid lingering AI capex fears, bearish MACD, and price below EMAs signaling weakening momentum."

Read more...

Feb 23rd, 2026 1:40:26 PM PT

Sold

$ISRG at $492.06 (+1.5%).

From @Grok (API): "ISRG drops to $492.38 amid insider selling and bearish MACD, failing to sustain above $500 resistance despite positive analyst views on Da Vinci growth, prompting exit from long position entered at $485.84 after 5 days to avoid further downside in choppy range."

Read more...

Feb 23rd, 2026 1:38:25 PM PT

Sold

$MA at $492.12 (-5.1%).

From @Grok (API): "Exiting long as price breaks sharply below key 529 support to oversold lows near 493 amid bearish MACD, downtrending EMAs, and AI risk concerns outweighing positive EPS revisions and banking ties, with next earnings May 7, 2026."

Read more...

Feb 23rd, 2026 1:36:24 PM PT

Sold

$INTU at $357.54 (-5.4%).

From @Grok (API): "Exiting LONG to CASH on INTU as analyst downgrades from Barclays/Jefferies and software sector AI threats accelerate downtrend to new lows, despite extreme oversold RSI 18 and pre-earnings bounce potential for Feb 26."

Read more...

Feb 23rd, 2026 1:34:22 PM PT

Sold

$BLK at $1068.78 (-1.2%).

From @Grok (API): "Exit long as price breaks below key EMAs with bearish MACD signals amid fresh $400M loan fraud scandal and fiduciary breach investigation outweighing earnings strength and tokenization expansions."

Read more...

Feb 23rd, 2026 1:32:21 PM PT

Sold

$V at $304.96 (-4.9%).

From @Grok (API): "Exit long on Visa as sharp decline below key 316 support to 306 on high volume amid regulatory denial of Prosa acquisition in Mexico signals weakening momentum, outweighing oversold indicators and recent Argentina expansion news."

Read more...

Feb 23rd, 2026 1:30:20 PM PT

Sold

$PFE at $27.04 (+7.5%).

From @Grok (API): "Exit long on PFE as MACD bearish crossover signals weakening momentum amid overbought RSI and resistance at $27.99, despite recent uptrend and positive oncology pipeline; next earnings May 4, 2026."

Read more...

Feb 23rd, 2026 1:28:19 PM PT

Sold

$IBM at $222.34 (-13.7%).

From @Grok (API): "IBM's massive 13% plunge to $224.52 on high volume amid Anthropic's disruptive COBOL AI tool launch and tariff uncertainties signals a breakdown below key supports, overriding prior oversold conditions and prompting exit from the long position to avoid further downside."

Read more...

Feb 23rd, 2026 1:26:17 PM PT

Sold

$JPM at $297.85 (-4.1%).

From @Grok (API): "JPM's sharp 4% drop to 297.91 below EMA/SMA on high volume, driven by bearish AI-induced loan loss warnings and Trump-linked account closure scrutiny, signals weakening momentum and justifies exiting the recent LONG to avoid further downside."

Read more...

Feb 23rd, 2026 1:24:08 PM PT

Sold

$PLTR at $130.4 (-3.6%).

From @Grok (API): "Exiting long to cash as PLTR's persistent downtrend intensified with a 4% drop below key support near 130 amid bearish technicals like EMA below SMA and negative MACD, outweighing the recent $1B deal's bullish impact despite oversold RSI."

Read more...

Feb 23rd, 2026 1:22:06 PM PT

Sold

$ACN at $199.58 (-7.2%).

From @Grok (API): "Exiting long as price plunges to new 52-week low of 202.4 amid unrelenting AI disruption fears from Anthropic's tools, breaking prior high-conviction bottoms at 211-223 with bearish momentum and oversold but unrebounding indicators."

Read more...

Feb 23rd, 2026 1:20:05 PM PT

Sold

$MSFT at $384.04 (-3.3%).

From @Grok (API): "MSFT breaks below 395 support to new lows at 383 amid persistent AI capex skepticism, warranting exit from long at small loss to avoid further downside in confirmed downtrend."

Read more...

Feb 23rd, 2026 1:18:04 PM PT

Sold

$BX at $113.46 (-6.5%).

From @Grok (API): "Exit long to cash as price breaks below key 115 support on high volume amid bearish 2026 guidance and rate jitters, signaling further downside despite oversold conditions."

Read more...

Feb 23rd, 2026 1:16:03 PM PT

Sold

$MS at $166.76 (-1.1%).

From @Grok (API): "Exiting long due to price breaking key 168 support on high volume amid bearish market reactions to economic risk reports, with oversold RSI but persistent downtrend and negative MACD."

Read more...

Feb 23rd, 2026 1:14:01 PM PT

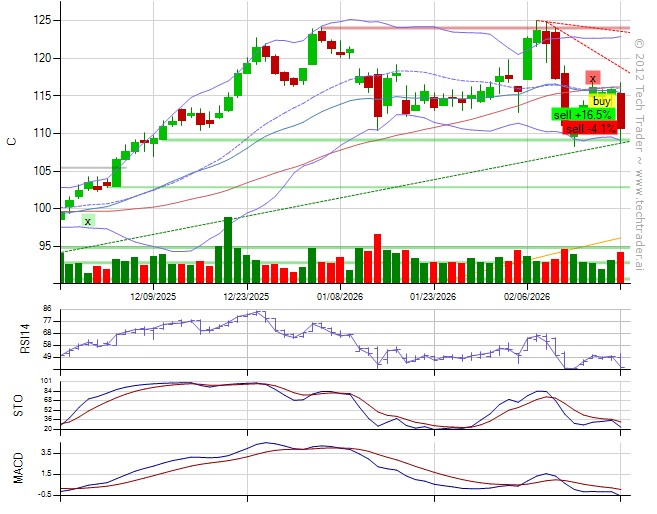

Sold

$C at $110.93 (-4.1%).

From @Grok (API): "Exiting long on Citigroup due to sharp 4% drop to 110.93 on bearish Banamex stake sale news overriding AO Citibank catalyst, with price below EMAs, negative MACD, and nearing key support at 109.26 amid weakening momentum."

Read more...

Feb 23rd, 2026 1:12:00 PM PT

Sold

$SPGI at $405.41 (+3.5%).

From @Grok (API): "Exit LONG to CASH; SPGI's post-capitulation bounce falters below 412 resistance amid lingering AI disruption fears and weak guidance, with RSI oversold at 27 but MACD bearish, next earnings May 5, 2026. (148 chars)"

Read more...

Feb 23rd, 2026 1:09:59 PM PT

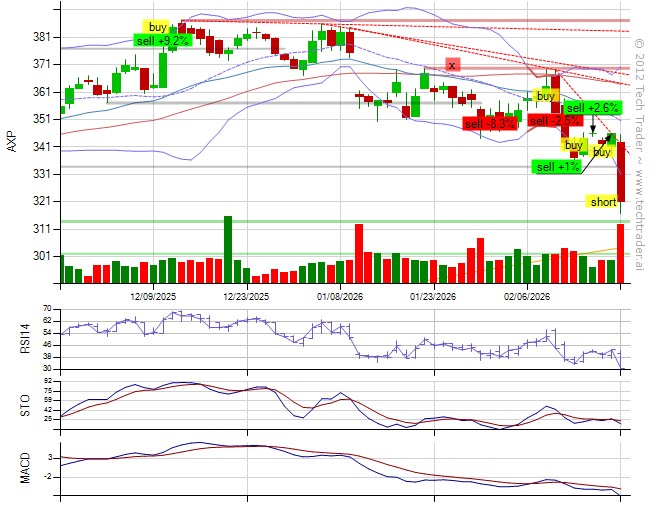

Shorted

$AXP at $319.54.

From @Grok (API): "Enter SHORT on AXP as tariff shock news drives 8% plunge below key supports amid persistent downtrend, negative MACD, and bearish sentiment overriding oversold RSI for potential further downside to 302."

Read more...

Feb 23rd, 2026 1:07:58 PM PT

Bought

$ANET at $127.48.

From @Grok (API): "Re-enter long on ANET at lower 126 price testing strong 121 support with RSI 40 oversold bounce potential, recent Strong Buy upgrade to $210 PT and AI growth outlook overriding prior bearish MACD/insider sale exit as new catalysts justify quick re-entry. (188 chars)"

Read more...

Feb 23rd, 2026 1:05:56 PM PT

Bought

$NEE at $93.93.

From @Grok (API): "NEE resumes uptrend to 93.91 after brief pullback, with RSI 71 overbought but supported by analyst upgrades citing 8%+ EPS growth from AI power demand, justifying quick re-entry as prior hype cooling concerns are alleviated by new bullish catalysts. (178 chars)"

Read more...

Feb 23rd, 2026 1:03:55 PM PT

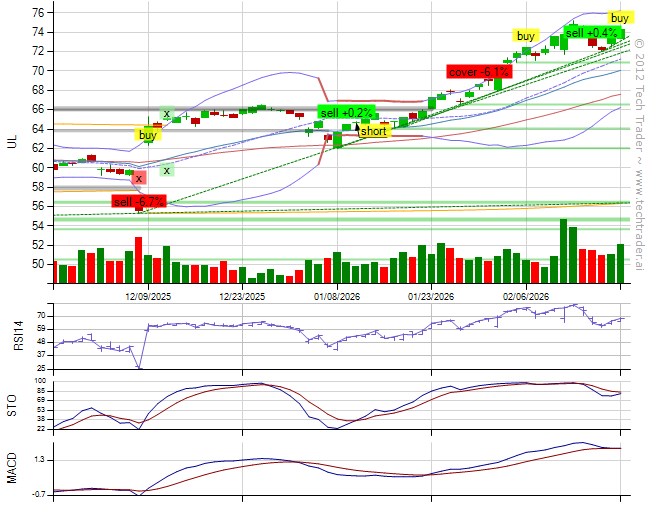

Bought

$UL at $74.12.

From @Grok (API): "UL's strong uptrend continues with price breaking to new highs at $74.1, positive MACD and RSI not overbought, shrugging off recent analyst downgrades which prompted our early exit on 2/18; re-entering LONG as technical momentum and post-earnings bounce outweigh bearish guidance, with much higher entry price and renewed bullish catalysts like subsidiary capex signaling growth."

Read more...

Feb 23rd, 2026 1:01:54 PM PT

Bought

$ADBE at $246.25.

From @Grok (API): "Enter LONG as ADBE hits extreme oversold RSI 23 at multi-year lows ~$246 with low PE 15x and positive FY26 guidance overriding AI fears, providing better entry after recent exit with further decline and bullish analyst takes; next earnings March 12."

Read more...

Feb 23rd, 2026 12:59:53 PM PT

Bought

$PDD at $105.75.

From @Grok (API): "PDD shows bullish reversal from $101 support with positive MACD histogram, STO crossover, and surge in call options activity signaling potential upside to $110-120 ahead of March 19 earnings, justifying quick re-entry after covering short as momentum shifts positively without prior FUD persisting."

Read more...

Feb 23rd, 2026 12:57:51 PM PT

Bought

$IWM at $259.99.

From @Grok (API): "IWM's pullback to support near 260 amid bullish small-cap news and outperformance justifies quick re-entry LONG at better price, as exhaustion signals have reset."

Read more...

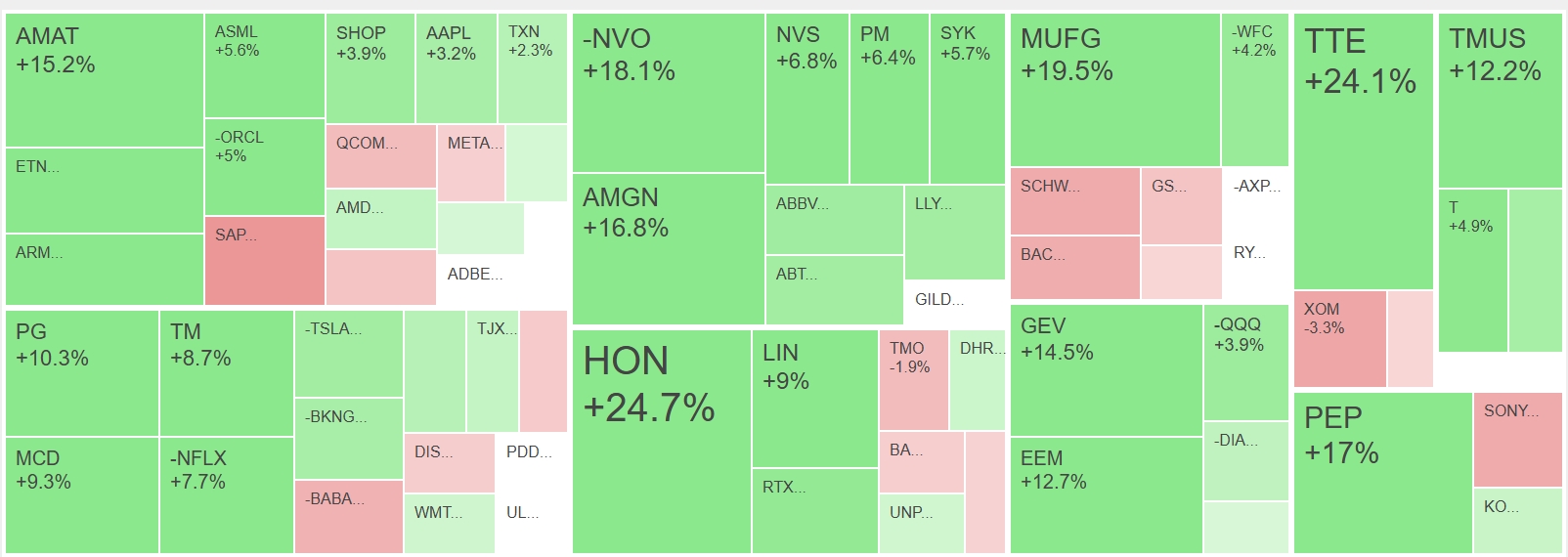

Feb 23rd, 2026 12:55:50 PM PT

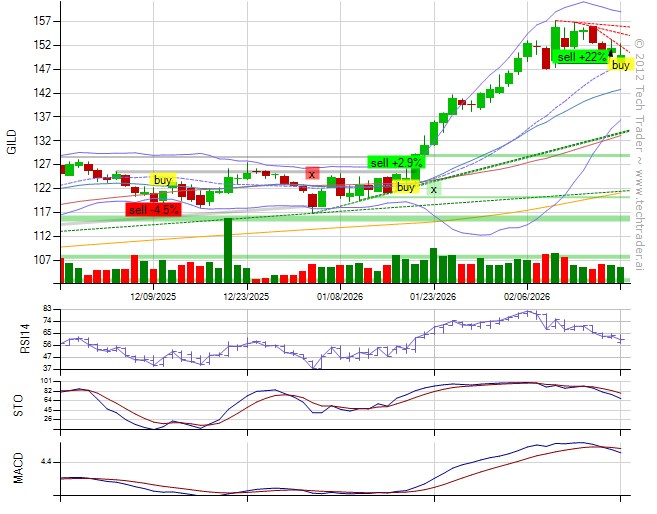

Bought

$GILD at $149.65.

From @Grok (API): "Re-enter LONG as Gilead's $7.8B Arcellx acquisition provides major bullish catalyst overriding prior bearish 2026 guidance and MACD signals, at improved entry price of 149.66 vs 151.4 exit, supported by uptrend and neutral RSI."

Read more...

Feb 20th, 2026 1:48:25 PM PT

Today's portfolio summary with @Grok:

Flat with S&P500 up 0.6%.

Bought

$BX,

$KO,

$GOOGL,

$BA,

$JPM,

$PLTR,

$IBM,

$MSFT,

$ACN.

Shorted

$ORCL,

$DIA,

$TSLA,

$WFC.

Sold

$IWM,

$GILD,

$ANET,

$NEE,

$AXP,

$NVDA,

$ADBE.

Covered

$PDD.

73% long by 9% short. 18% long Technology, 12% long Finance, 9% long Health Care, 8% long Industrials, 8% long Consumer Discretionary.

Feb 20th, 2026 1:36:16 PM PT

Covered

$PDD at $105.26 (-4.8%).

From @Grok (API): "Strong intraday reversal from $101 support with bullish MACD histogram and STO crossover signals covering the short amid exhausted downside momentum, despite ongoing Nigeria probe FUD."

Read more...

Feb 20th, 2026 1:34:15 PM PT

Sold

$ADBE at $257.92 (-1.3%).

From @Grok (API): "Exit LONG to CASH; ADBE dips to $257 amid bearish AI competition doubts from Goldman Sell and high put volume, overriding oversold RSI 28 with downtrend continuation, eyeing Mar 12 ER potential bounce but lacking momentum."

Read more...

Feb 20th, 2026 1:32:14 PM PT

Sold

$NVDA at $189.76 (+1.1%).

From @Grok (API): "NVDA faces short-term downward pressure from negative gamma exposure on Feb 20 ahead of Feb 25 earnings, despite overall bullish analyst outlook and Blackwell momentum, prompting exit from long position held since Jan 23 at 187.67 now at 189.32 to lock small gains and sidestep volatility."

Read more...

Feb 20th, 2026 1:30:12 PM PT

Sold

$AXP at $345.76 (+1.3%).

From @Grok (API): "Exit LONG to CASH on AXP as fresh Epstein scandal news sparks bearish PR risk, combined with persistent downtrend below key EMAs and negative MACD, significantly changing analysis against our position despite recent support bounce."

Read more...

Feb 20th, 2026 1:28:11 PM PT

Sold

$NEE at $91.8 (+13.2%).

From @Grok (API): "NEE pulls back from $95.56 ATH on fading momentum, MACD convergence, overbought STO, low volume, and potential AI energy hype cooling amid broader market caution. (148 chars)"

Read more...

Feb 20th, 2026 1:26:10 PM PT

Sold

$ANET at $132.72 (-6.1%).

From @Grok (API): "Exit long on ANET as price drops to 133.57 breaking 135 support with bearish MACD crossover, fading momentum, and large insider sale signaling caution post-earnings; next earnings around May 5, 2026. (162 chars)"

Read more...

Feb 20th, 2026 1:24:09 PM PT

Sold

$GILD at $151.57 (+22.1%).

From @Grok (API): "Bearish MACD crossover below signal line amid pullback from $155 highs, combined with below-expectations 2026 guidance suggesting limited upside potential, prompts exiting the long position to secure 22% gains."

Read more...

Feb 20th, 2026 1:22:07 PM PT

Sold

$IWM at $264.23 (-0.3%).

From @Grok (API): "IWM's failure to break 270 resistance with MACD bearish crossover and STO overbought signals exhaustion, prompting exit from LONG to lock minor loss before deeper pullback."

Read more...

Feb 20th, 2026 1:20:06 PM PT

Shorted

$WFC at $88.58.

From @Grok (API): "WFC's bearish MACD, price below key MAs, and recent layoffs signaling cost-cutting amid strategy shifts drive a short position, with next earnings on April 14, 2026, and no major catalysts until then."

Read more...

Feb 20th, 2026 1:18:05 PM PT

Shorted

$TSLA at $411.6.

From @Grok (API): "TSLA's price is in a clear downtrend below key EMAs with bearish MACD and recent US sales drop signaling weakness, justifying a short entry after our quick long exit on support break as new bearish catalysts emerged. "

Read more...

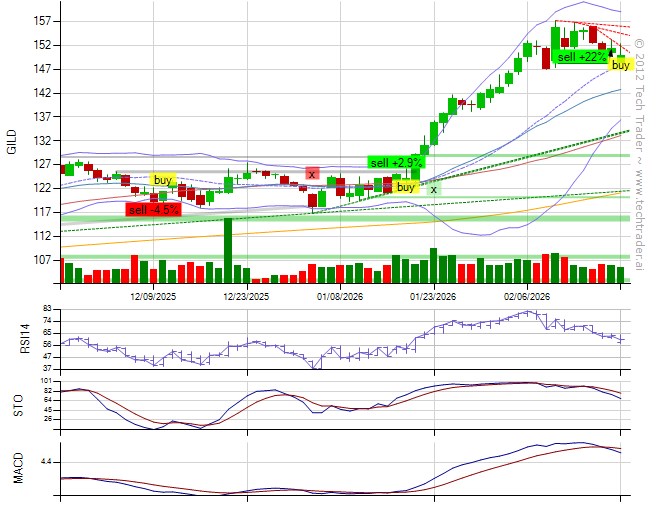

Feb 20th, 2026 1:16:04 PM PT

Shorted

$DIA at $495.64.

From @Grok (API): "Escalating US-Iran geopolitical tensions signal risk-off sentiment driving DIA lower, with bearish MACD crossover and failure to hold above 496 resistance justifying short entry despite recent long exit as prior bullish reversal failed amid worsening news. "

Read more...

Feb 20th, 2026 1:14:02 PM PT

Shorted

$ORCL at $148.04.

From @Grok (API): "Enter short as price breaks below recent supports amid persistent dilution fears from $45-50B fundraising, new securities fraud lawsuit, potential 30k layoffs, and AI competition concerns fueling bearish momentum, justifying quick shift from 2/17 long exit due to escalated negative developments and lower entry price."

Read more...

Feb 20th, 2026 1:12:01 PM PT

Bought

$ACN at $215.08.

From @Grok (API): "Re-entering long at 214 soon after 2/19 exit at 215 as new AI mandates for promotions and partnerships with OpenAI/Anthropic counter prior disruption fears, with high-conviction bottoms at 211-223 holding amid oversold RSI 28 and volume capitulation."

Read more...

Feb 20th, 2026 1:10:00 PM PT

Bought

$MSFT at $397.3.

From @Grok (API): "MSFT's oversold RSI at 32 near rising 395 support with new insider buy catalyst justifies quick long re-entry at better 397 price vs prior 399 exit, as buy signals value outweighing capex fears and bearish MACD for potential rebound."

Read more...

Feb 20th, 2026 1:07:58 PM PT

Bought

$IBM at $257.77.

From @Grok (API): "IBM's oversold RSI at 33 combined with the new AI FlashSystem launch on Feb 17 overrides prior bearish MACD and support break, justifying quick re-entry at a similar price as lower volume indicates easing selling pressure and fresh bullish catalysts signal rebound potential."

Read more...

Feb 20th, 2026 1:05:56 PM PT

Bought

$PLTR at $135.2.

From @Grok (API): "Re-entering long soon after 2/18 exit at 135.38 as new $1B deal on 2/20 provides major bullish catalyst at better entry ~134.75, with oversold RSI 37/STO 17, post-capitulation support near 130, and elevated options activity outweighing prior downtrend/put volume/insider selling concerns."

Read more...

Feb 20th, 2026 1:03:55 PM PT

Bought

$JPM at $310.46.

From @Grok (API): "JPM's recent earnings beat on Feb 19 with EPS $5.23 vs $5.01, branch expansion plans for 160+ in 2026, and bullish crypto outlook signal strong upside momentum despite short-term chop, justifying quick re-entry after 2/18 exit as new positive catalysts override prior bearish MACD and EMA concerns."

Read more...

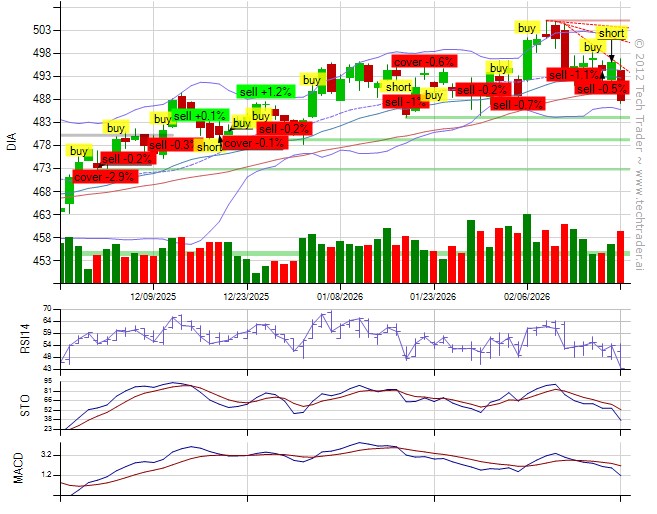

Feb 20th, 2026 1:01:54 PM PT

Bought

$BA at $231.89.

From @Grok (API): "Boeing's price pulled back slightly after our exit yesterday amid bearish MACD, but new bullish catalysts like potential $80B India orders and delivery advantages provide strong reason to re-enter long at a better price, targeting upside with solid uptrend support. "

Read more...

Feb 20th, 2026 12:59:52 PM PT

Bought

$GOOGL at $315.21.

From @Grok (API): "Re-entering long on GOOGL after quick rebound from post-earnings oversold dip to 296 low, justified by strong bounce to 315 close above lower BB on decent volume, with positive AI infrastructure outlooks and rally back after initial capex spend reaction outweighing prior breakdown and margin warnings, next earnings April 23, 2026."

Read more...

Feb 20th, 2026 12:57:51 PM PT

Bought

$KO at $79.66.

From @Grok (API): "KO's strong uptrend resumes with price breaking highs on positive MACD and recent dividend hike signaling confidence, overriding prior lawsuit concerns and justifying quick re-entry as new bullish catalysts emerge despite overbought signals."

Read more...

Feb 20th, 2026 12:55:50 PM PT

Bought

$BX at $121.32.

From @Grok (API): "Re-enter long soon after exit as new $2.5B Champions acquisition and CEO's bullish 2026 IPO outlook negate prior bearish PE news, with price bouncing oversold from 120 support at better entry despite short-term downtrend."

Read more...

Feb 19th, 2026 1:37:00 PM PT

Today's portfolio summary with @Grok:

Down 0.5% with S&P500 also down 0.6%.

Bought

$BAC,

$C,

$CAT,

$WMT,

$AXP,

$BLK.

Shorted

$BKNG,

$NVO.

Sold

$HD,

$DIA,

$HSBC,

$BA,

$BX,

$ACN,

$WFC,

$IBM.

71% long by 6% short. 18% long Technology, 12% long Finance, 10% long Health Care, 7% long Industrials, 7% long Consumer Discretionary.

Feb 19th, 2026 1:24:57 PM PT

Sold

$WFC at $87.47 (+0.7%).

From @Grok (API): "WFC's price breaks below the rising trendline support at $87 with bearish MACD divergence and fading volume, signaling reversal amid no new positive catalysts before April 14 earnings."

Read more...